As of January 2024, license holders have the option to register LLCs and S-Corporations (S-Corps) with TREC for the sole purpose of receiving compensation, as long as those entities meet certain requirements.

Where to Go to Register

Log in to the Online Licensing Services portal to access your account.

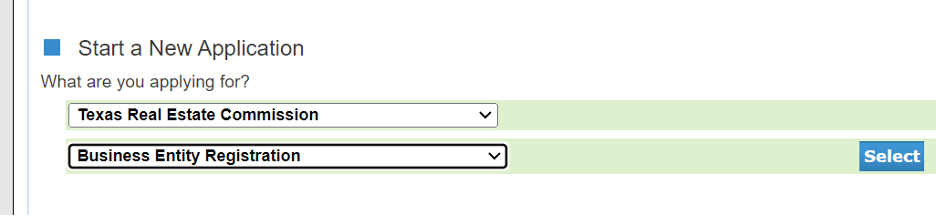

Go to the Start a New Application section and choose Business Entity Registration from the dropdown menu.

Next, you’ll be reminded what types of LLCs and S-Corps are eligible to register and the documents you need to submit to TREC to support your registration.

On the following screens, be prepared to provide your organization’s name and tax number, your contact information, and answer a few questions about the history of your business.

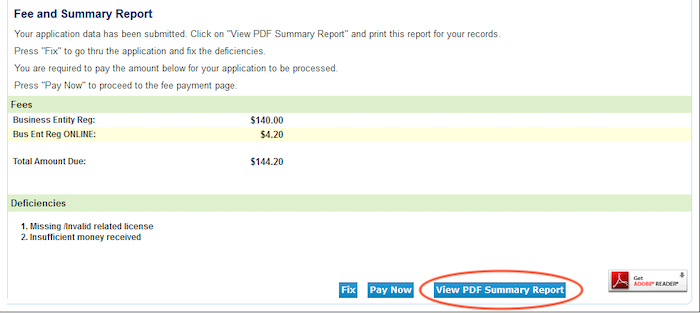

If you would like a PDF of your application, click the View PDF Summary Report button.

Once you submit the online form and your payment, you’ll need to email your supporting documents to TREC so staff can begin processing your application.

You will receive a letter from TREC when your registration is approved. It is only then that you may begin using the business entity to receive compensation.

Where to Find More Details

Here is where you’ll find more information about business entity registration, including some frequently asked questions, a helpful chart, and a short video.