As of now, the only way a license holder can receive compensation through a business entity is by obtaining a business entity real estate broker license. Effective January 2024, license holders will have the option to register LLCs and S-Corporations (S-Corps) with TREC for the sole purpose of receiving compensation, as long as those entities meet certain requirements.

Business entity registration is a result of Senate Bill 1577, passed by the 88th Texas Legislature, which amends The Real Estate License Act (TRELA) to add it as an option in addition to the business entity real estate broker license.

Are Business Entity Broker Licenses Going Away?

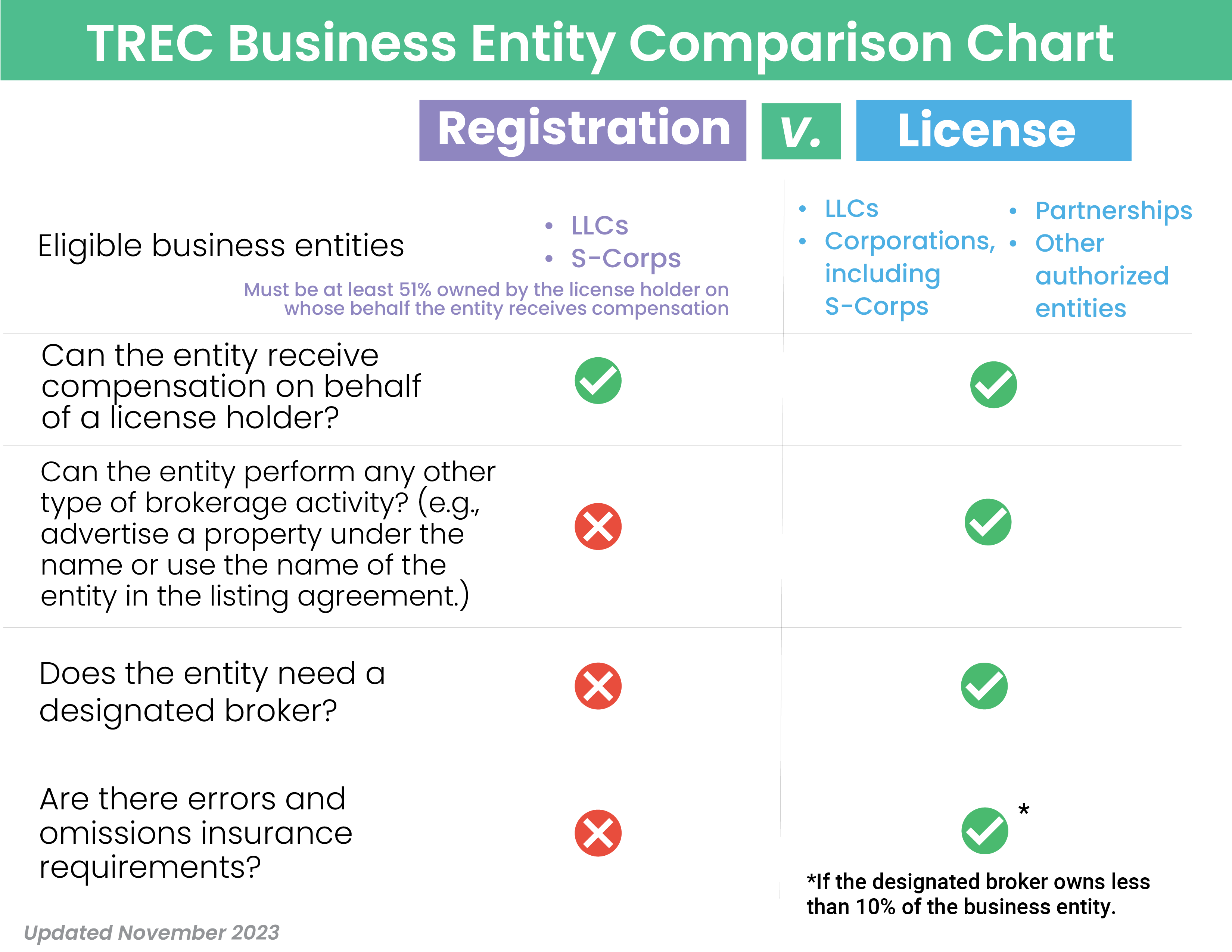

No. You will still have the option to keep or pursue a business entity broker license, which you should do if you intend to do anything more than accept compensation. There are benefits to holding a business entity broker license versus registration, such as the ability to use the name of the entity to advertise or as a party in a listing or buyer representation agreement. Here’s what you should know if you want to apply for a business entity registration next year.

Business Entity Registration Versus Business Entity License

LLCs and S-Corps used for registration must be at least 51% owned by the license holder on whose behalf the entity receives compensation.

Importantly, you cannot use the LLC or S-Corp that you register with TREC to receive compensation to perform any other type of brokerage activity. Doing so would be unlicensed activity and would result in disciplinary action.

The TREC Business Entity Comparison chart below outlines some of the differences between business entity registration and the business entity broker license.

Advice for Brokers and Sales Agents by a Broker

In the below video, TREC Commissioner Chance Brown clarifies what this change means for brokers and sales agents, and how each does business.

Business Entity Registration FAQs

Can I keep my business entity broker license instead of getting a registration? Yes.

What type of entity should I create? TREC cannot advise you on business decisions. A private attorney or tax professional may be able to assist you. Only certain types of business entities—LLCs and S-corps—are eligible for the registration, however.

Does TREC have requirements related to naming LLCs or S-Corps for registration? TREC does not have requirements about the name of your LLC or S-Corp, because advertising is not permitted with a registration. Other state or federal laws may come into play. As a result, you may wish to consult with a private attorney.

How will I register my business entity with TREC? The registration process will take place entirely online. You will need to provide supporting documentation to establish that the business entity type is eligible for the registration and that you own at least 51% of the business entity. Get the list of supporting documentation.

Can I start using my business entity to receive compensation as soon as I submit my application? No. You may only begin using your business entity to receive compensation once your registration application is approved by TREC, which can take up to 10 business days.

Like all other TREC applications, business entity registration applications require thorough review to ensure your application is complete and meets the requirements.

How will I know my registration is approved? You will receive a letter confirming your registration is approved.

I’m ready to register my business entity. What should I do now? If you have a current business entity broker license, do not let it expire. Business entity registration is not available until January 2024.

I no longer wish to have a business entity broker’s license and I would prefer to have a registration instead. What should I do? If you have a business entity broker’s license and you wish to register that entity instead, you must first wait for your business entity broker’s license to expire. You can then proceed with the registration process. Remember, you cannot receive compensation through a business entity registration until it is approved by the Commission.

I’m still trying to determine if this is the right choice for me. Who should I consult? Ultimately, this is a business decision, and TREC staff cannot give you advice. You may want to consult with your broker, CPA, or private attorney about what makes sense for your specific situation.